News

2019

TORONTO, ONTARIO - January 24, 2019 - Americas Silver Corporation (TSX: USA) (NYSE American: USAS) (“Americas Silver” or the “Company”) today announced production and operating cost results for fiscal 2018 on a consolidated basis and individually for its Cosalá Operations and Galena Complex. All figures are in U.S. dollars unless otherwise indicated.

Fiscal 2018 Highlights

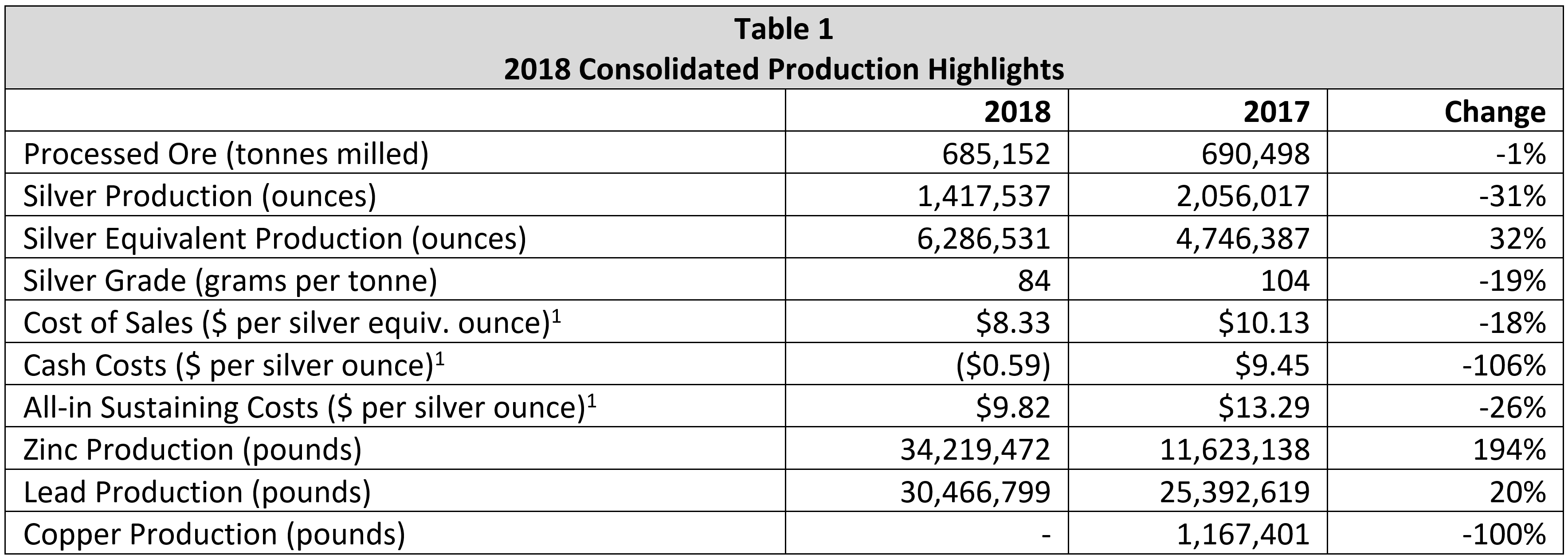

- Consolidated production for the year of approximately 6.3 million silver equivalent[1] ounces and 1.4 million silver ounces, representing an increase of 32% and a decrease of 31%, respectively, when compared to fiscal 2017.

- Consolidated cash costs[2] for the year were approximately negative ($0.59) per silver ounce, a decrease of approximately 105% when compared to fiscal 2017, while consolidated all-in sustaining costs[2] (“AISC”) were approximately $9.82 per silver ounce, a decrease of 26% year-over-year.

- Consolidated production for Q4, 2018 of approximately 1.8 million silver equivalent ounces and 0.4 million silver ounces, representing increases of 28% and 22%, respectively, when compared to Q3, 2018.

- Consolidated cash costs for Q4, 2018 were approximately $1.27 per silver ounce, a decrease of approximately 74% when compared to Q3, 2018, while consolidated AISC were approximately $11.86 per silver ounce, a decrease of 26% quarter-over-quarter.

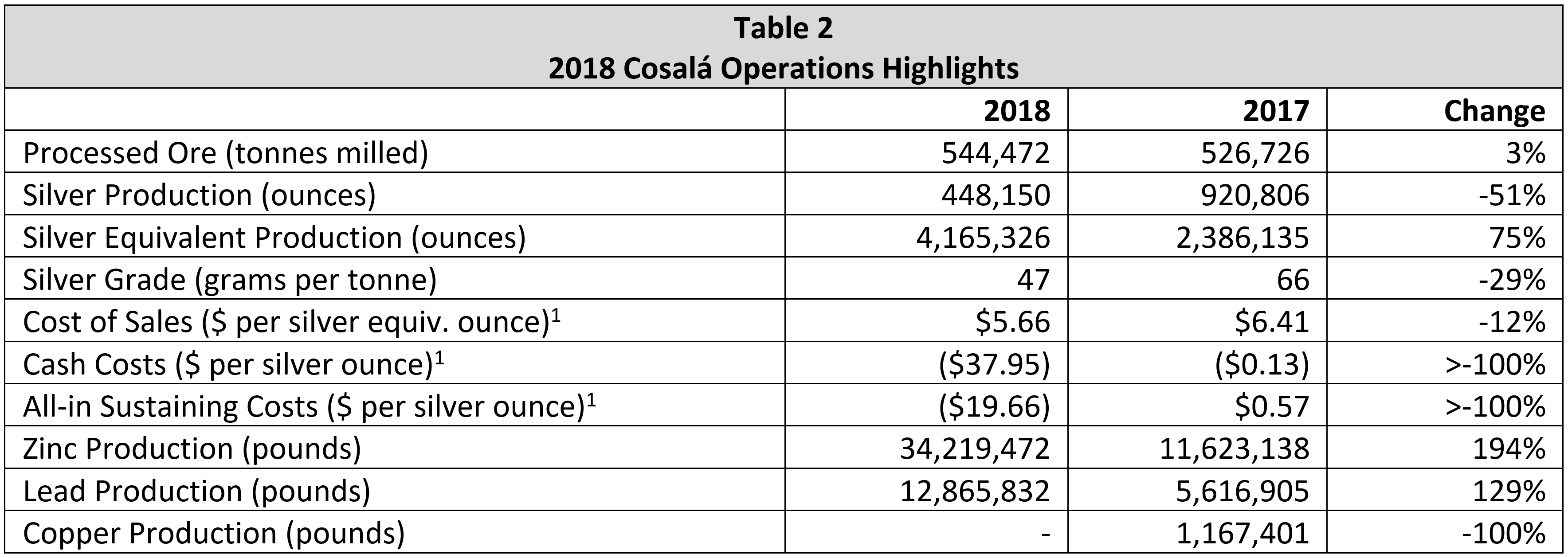

- Cosalá Operations milled tonnage increased by 3% over fiscal 2017 as San Rafael achieved its goal of sustaining a milling rate of over 1,700 tonnes per operating day by the end of the third quarter of the year. Production for the year of approximately 4.2 million silver equivalent ounces including approximately 450,000 silver ounces, representing an increase of 75% and decrease of 51%, respectively, when compared to fiscal 2017.

- Cosalá Operations cash costs were approximately negative ($37.95) per silver ounce and AISC were approximately negative ($19.66) per silver ounce, representing significant decreases year-over-year from cash costs of negative ($0.13) per silver ounce and AISC of $0.57 per silver ounce.

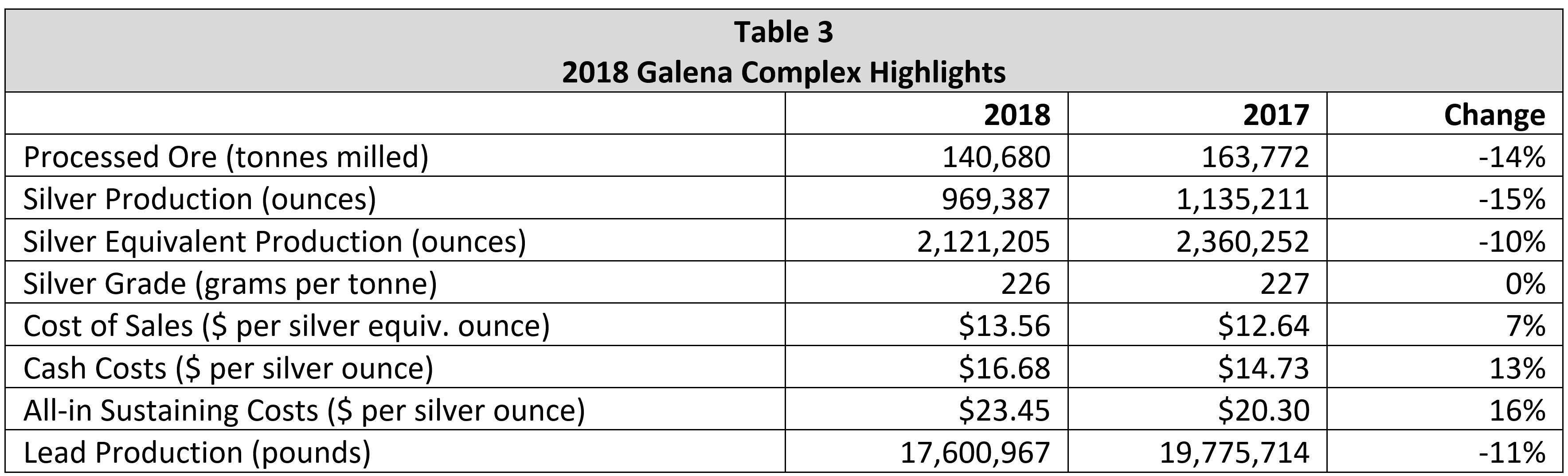

- During 2018, Galena Complex production was negatively impacted by two separate issues at its No.3 Shaft that inhibited normal hoisting for approximately 27 days in total. As a result, production for the year was approximately 2.1 million silver equivalent ounces and 1.0 million silver ounces, representing decreases of 10% and 15%, respectively, when compared to fiscal 2017.

- Galena Complex cash costs were approximately $16.68 per silver ounce and AISC were approximately $23.45 per silver ounce, representing increases of 13% and 16%, respectively, year-over-year.

- The Company had cash and cash equivalents of $3.5 million at December 31, 2018.

“The fourth quarter of 2018 was the best production quarter and representative of expected production going forward, with San Rafael reaching targeted throughput levels, and improved operating performance at Galena in 2019,” said Darren Blasutti, President & CEO of Americas Silver. “With the votes now successfully behind us for both Americas Silver and Pershing Gold, we are only waiting on the CFIUS review prior to closing the transaction. We expect to announce the transaction closing, concurrent with a mine construction decision, and a financing announcement that we expect to fully fund the development of the Relief Canyon Project.”

Pershing Acquisition Update and 2019 Guidance

On January 9, 2019, Americas Silver Corporation and Pershing Gold Corporation (“Pershing Gold”) announced their respective shareholders provided the requisite approvals for the previously announced business combination transaction (the “Transaction”) between the two companies. Completion of the Transaction remains subject to satisfaction or waiver of certain customary conditions, including the completion of review and approval by the Committee on Foreign Investment in the United States (“CFIUS”) (discussed in Americas Silver’s January 2, 2019 press release). All deadlines for declarations and transactions under review by CFIUS are currently tolled due to the lapse in appropriations attributable to the partial U.S. government shutdown.

In anticipation of the closing of the Transaction, discussions are proceeding well with parties interested in providing financing for the development of the Relief Canyon Mine. As a result of the delay in closing, the Company is assessing its 2019 guidance and intends to update the market upon completion of the Transaction.

Consolidated 2018 Production Details

Consolidated silver equivalent production for fiscal 2018 was approximately 6,286,531 ounces, an increase of 32% over fiscal 2017. Consolidated silver production for fiscal 2018 was 1,417,537 silver ounces, a decrease of 31% over fiscal 2017. The significant increase in consolidated silver equivalent production and decrease in silver production relative to 2017 was primarily the result of the San Rafael mine having its first full year of operation after declaring commercial production in December 2017. San Rafael contributed over 190% greater zinc production and over 125% greater lead production, though with approximately 50% lower silver production due to mine sequencing. Similarly, consolidated cash costs decreased over 100% to negative ($0.59) per silver ounce compared to fiscal 2017, and AISC decreased 26% to $9.82 per silver ounce compared to fiscal 2017.

1 Cost of sales per silver equivalent ounce, cash costs per silver ounce, and all-in sustaining costs per silver ounce for 2017 excludes pre-production of 50,490 silver ounces and 435,323 silver equivalent ounces mined from San Rafael during its commissioning period, and excludes pre-production of 245,391 silver ounces and 360,530 silver equivalent ounces mined from El Cajón during its commissioning period. Pre-production revenue and cost of sales from San Rafael and El Cajón were capitalized as an offset to development costs.

Cosalá Operations Production Details

The Cosalá Operations produced 448,150 ounces of silver and 4,165,326 ounces of silver equivalent during the year at cash costs of negative ($37.95) per silver ounce and AISC of negative ($19.66) per silver ounce. Silver equivalent production increased 75% year-over-year and silver production decreased 51% over fiscal 2017. Cash costs and AISC were down significantly compared to the fiscal 2017 from negative ($0.13) per silver ounce and $0.57 per silver ounce, respectively. The improvements in silver equivalent production and cash costs were the result of the significant increase in zinc (194%) and lead production (129%) from the San Rafael mine compared to fiscal 2017 when the Company was transitioning from its previous mine, the silver-copper-zinc-lead Nuestra Señora mine.

Galena Complex Production Details

As previously announced, production at the Galena Complex was negatively impacted by two issues affecting the No.3 Shaft: a 10-day suspension of hoisting in late April to allow the repair of steel sets in the shaft, and a 17-day shutdown of the hoist in June to address a mechanical failure in the brake mechanism. The Complex was temporarily considered to be on care and maintenance for the 17-day shutdown as repairs were performed with certain costs excluded from the cash costs and AISC calculations. Repairs were completed by the end of June 2018.

As a result, the Galena Complex produced 969,387 ounces of silver and 2,121,205 ounces of silver equivalent during the year at cash costs of $16.68 per silver ounce and AISC of $23.45 per silver ounce, respectively. Silver and silver equivalent production decreased 15% and 10%, respectively, compared to fiscal 2017. Cash costs increased by 13% compared to fiscal 2017, and AISC were up 16% year-over-year.

About Americas Silver Corporation

Americas Silver is a precious metal mining company focused on growth from its existing asset base and execution of targeted accretive acquisitions. It owns and operates the Cosalá Operations in Sinaloa, Mexico and the Galena Complex in Idaho, USA. Americas Silver holds an option on the San Felipe development project in Sonora, Mexico. For further information please see SEDAR or americassilvercorp.com.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information includes, but is not limited to, Americas Silver’s and Pershing Gold’s expectations, intentions, plans, assumptions and beliefs with respect to, among other things, Americas Silver’s financing efforts; the consummation of the Transaction; construction, production, and development plans at Relief Canyon Mine; the timing of the closing of the Transaction; the completion of CFIUS review and its recommendations; and the estimated construction timeline for Relief Canyon Mine. Often, but not always, forward-looking information can be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “goal”, “plan”, “intend”, “estimate”, “may”, “assume” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of Americas Silver and Pershing Gold as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of Americas Silver or Pershing Gold to be materially different from those expressed or implied by such forward-looking information. With respect to the Transaction, these risks and uncertainties include the risk that Americas Silver or Pershing Gold may be unable to obtain any regulatory approvals required for the Transaction, including CFIUS approval, or that regulatory approvals may delay the Transaction or cause the parties to abandon the Transaction; the risk that other conditions to closing may not be satisfied; the length of time needed to consummate the proposed Transaction, which may be longer than anticipated for various reasons; the risk that the businesses will not be integrated successfully; the diversion of management time on Transaction‐related issues; the risk that costs associated with the integration are higher than anticipated; and litigation risks related to the Transaction. With respect to the businesses of Americas Silver and Pershing Gold, these risks and uncertainties include interpretations or reinterpretations of geologic information; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company and Pershing Gold operate; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms or at all; the ability to develop and operate the Relief Canyon property; and risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), ground conditions and other factors limiting mine access, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital expenditures, reclamation activities, labor relations, social and political developments and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Pershing Gold’s filings with the SEC, including the Annual Report on Form 10‐K for the year ended December 31, 2017 and the Proxy Statement of Pershing Gold dated November 29, 2018, and in Americas Silver’s filings with the Canadian Securities Administrators on SEDAR and with the SEC, including the management information circular of Americas Silver dated December 4, 2018. Neither Americas Silver nor Pershing Gold undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law. Neither Americas Silver nor Pershing Gold gives any assurance (1) that Americas Silver and Pershing Gold will achieve its expectations, or (2) concerning the result or timing thereof. All subsequent written and oral forward‐looking information concerning Pershing Gold, Americas Silver, the proposed Transaction, the combined company or other matters attributable to Pershing Gold or Americas Silver or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above.

No Offer or Solicitation

This press release is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer or sale of securities shall be made except pursuant to registration under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), and any applicable state securities laws or in compliance with an exemption therefrom.

For more information:

Darren Blasutti

President and CEO

416‐848‐9503

[1] Silver equivalent production throughout this press release was calculated based on silver, zinc, lead and copper realized prices during each respective period.

[2] Cash cost per ounce and all-in sustaining cost per ounce are non-IFRS performance measures with no standardized definition. For further information and detailed reconciliations, please refer to the Company’s 2017 year-end and quarterly MD&A. The performance measures for the quarter ended December 31, 2018 are preliminary throughout this press release subject to refinement from the Company’s year-end financial results to be released on or before March 7, 2019.