News

2019

TORONTO, ONTARIO - August 12th, 2019 - Americas Silver Corporation (TSX: USA) (NYSE American: USAS) (“Americas Silver” or the “Company”), a growing North American precious metals producer, today reported consolidated financial and operational results for the second quarter of 2019.

This earnings release should be read in conjunction with the Company’s Management’s Discussion and Analysis, Financial Statements and Notes to Financial Statements for the corresponding period, which have been posted on the Americas Silver Corporation SEDAR profile at www.sedar.com, on its EDGAR profile at www.sec.gov, and are also available on the Company’s website at www.americassilvercorp.com. All figures are in U.S. dollars unless otherwise noted.

Second Quarter Highlights

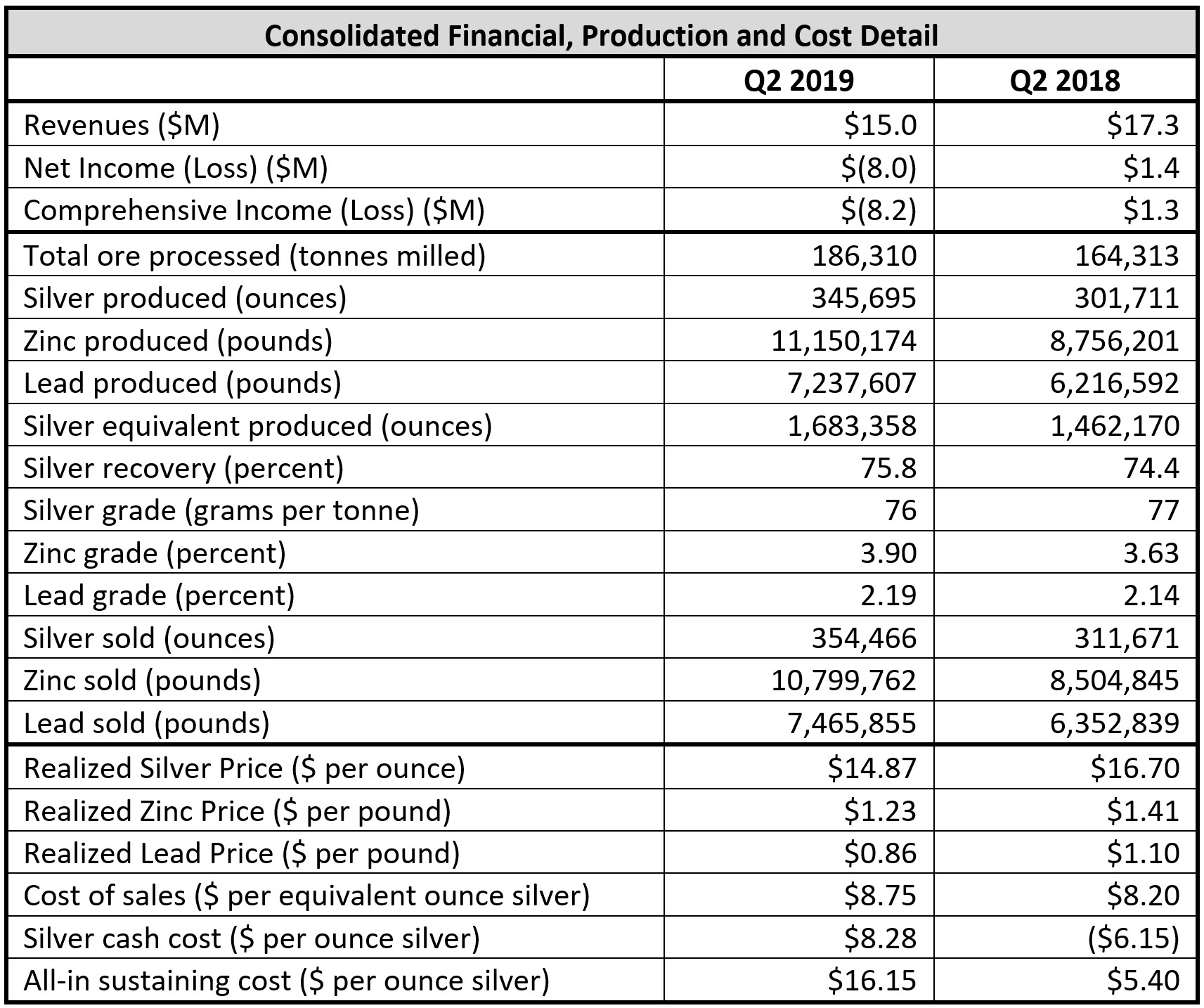

- Revenue of $15 million and net loss of $8 million for the quarter or ($0.11) per share, a decrease of $2.3 million in revenue and an increase in the net loss of $9.4 million compared to Q2-2018 due primarily to lower realized metal prices, higher treatment and refining charges, non-reoccurring expenses associated with the Pershing Gold Corporation (“Pershing Gold”) acquisition, incremental interest and financing costs, loss on derivative instruments associated with the Sandstorm Gold Ltd. (“Sandstorm”) convertible debenture and non-cash share-based payments.

- Relief Canyon Mine construction and costs are proceeding as expected at the Relief Canyon Mine with leach pad liner installation progressing, and mobilization of the mining contractor and all fabrication work on the crusher and conveyors progressing to meet scheduled delivery in the third quarter. First gold pour is expected in late Q4-2019.

- Guidance for 2019 remains unchanged at 1.6 – 2.0 million silver ounces and 6.6 – 7.0 million silver equivalent ounces at cash costs of $4.00 to $6.00 per silver ounce and AISC of $10.00 to $12.00 per silver ounce.

- For the first half of 2019, consolidated silver production of approximately 3.4 million silver equivalent ounces[1] and 0.7 million silver ounces at consolidated cash costs[2] of approximately $3.60 per silver ounce and consolidated all-in sustaining costs2 (“AISC”) of approximately $10.50 per silver ounce.

- Pre-reported second quarter consolidated silver production of approximately 1.7 million silver equivalent ounces and 0.3 million silver ounces, representing an increase of 15% year-over-year to both silver and silver equivalent.

- Pre-reported second quarter consolidated cash costs of $8.28 per silver ounce and AISC of $16.15 per silver ounce, both representing an increase year-over-year and from the prior quarter. These increased costs were primarily the result of lower realized prices for zinc and lead and lower production at the Galena Complex.

- The Company had a cash balance of $6.3 million as at June 30, 2019. The Company has not drawn down on the $25 million Sandstorm Gold Purchase Agreement.

- Subsequent to the quarter, Eric Sprott made a $10 million investment in the Company by a private placement in the Company’s common stock.

“Quarterly earnings and cash flow were impacted by 15% lower realized metal prices, a reduction in Galena production due to a focus on development, and by a number of one-time items associated with the closing of the Pershing Gold transaction,” said Darren Blasutti, President & CEO of Americas Silver. “The second half of the year is expected to bring not only higher silver production from our current operations but Relief Canyon’s first gold pour into a rapidly rising gold and silver price environment.”

Consolidated Results

Despite slightly higher production, revenue was negatively impacted as precious and base metal prices globally decreased year-over-year. Realized prices for silver, zinc and lead decreased significantly representing 11%, 13%, and 22% declines, respectively. Further impacting revenue, treatment and refining charges increased by approximately $2.8 million or 45% over Q2-2018 as a result of a reduction in global zinc smelting capacity.

Consolidated silver equivalent production and silver production both increased by 15% year-over-year as the Company’s San Rafael mine in Mexico continued to have another record quarter for Q2-2019 as silver, zinc and lead production increased by 54%, 27%, and 36%, respectively,. The record results at the Cosalá Operations were driven by sustained improvements in mill throughput, grade, and metal recovery to concentrate. San Rafael increased tonnage by 13% and sustained an average milling rate of approximately 1,750 tonnes per operating day. Silver grade and recovery both increased by approximately 17% with by-product grades and recoveries also increasing.

These results were offset by a reduction in production at the Galena Complex as mining operations focused on development over production given the lower silver and lead prices realized during the quarter. As previously noted in Q1-2019, two high-tonnage stopes at the Galena Complex were impacted by separate ground falls in late Q1-2019 with follow-on impact in Q2-2019. The remaining active stopes were unable to replace the tonnage loss associated with the impacted areas. Underground development was prioritized gaining over 1,600 feet of advance in order to improve mining flexibility with new production areas established on the 2400 and 3200 levels.

In addition, the Company’s profitability was affected by non-reoccurring charges associated with the Pershing Gold acquisition, specifically transaction costs, loss on derivative instruments associated with the Sandstorm convertible debenture, as well as higher depletion and amortization of the San Rafael Mine, and the timing of non-cash share-based payments after the Pershing Gold acquisition closing.

Consolidated cash costs increased significantly due to higher treatment and refining charges and lower market prices for both zinc and lead during the quarter. Operating costs and capital expenditures remain in line with management expectations.

Further information concerning the consolidated and individual mine operations is included in the Company’s second quarter Condensed Interim Consolidated Financial Statements for the six months ended June 30, 2019 and Management’s Discussion and Analysis for the six months ended June 30, 2019.

Relief Canyon Update

Construction is advancing well at the fully funded Relief Canyon Mine. The leach pad construction is over 40% complete, with liner installation progressing rapidly. Mobilization of the mining contractor occurred in early August, currently supporting overliner crushing. Mine development will commence in early September. Work at the existing processing plant has started where upgrades will be made to the refinery and emissions controls. Furthermore, five in-fill drill holes were completed during the quarter in support of the current resource model. Updates on the Relief Canyon development will be made available periodically on the Company’s website as construction progresses at www.americassilvercorp.com.

Q2-2019 Earnings Conference Call

President & CEO Darren Blasutti will be hosting a Q2-2019 earnings conference call on Monday, August 12th, 2019 at 4:30pm EDT. A copy of the presentation will be made available on the company’s website at www.americassilvercorp.com.

Step 1: Dial-In

Canada and USA Toll-Free 1-877-283-6515

International Toll Number +1-416-981-9027

Step 2: Online Login

https://cc.callinfo.com/r/1ltn3gfvkvfxw&eom

Callers are advised to dial-in 10-15 minutes prior to the call. As there is no audio on the participant URL, please dial-in to follow along with the presentation.

About Americas Silver Corporation

Americas Silver is a precious metal mining company focused on growth from its existing asset base and execution of targeted accretive acquisitions. It owns and operates the Cosalá Operations in Sinaloa, Mexico and the Galena Complex in Idaho, USA. The Company expects to begin producing gold in the fourth quarter of 2019 at its fully funded Relief Canyon Mine in Nevada, USA which is currently in construction. The Company also holds an option on the San Felipe development project in Sonora, Mexico.

Daren Dell, Chief Operating Officer and a Qualified Person under Canadian Securities Administrators guidelines, has approved the applicable contents of this news release. For further information please see SEDAR or americassilvercorp.com.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information includes, but is not limited to, Americas Silver’s expectations, intentions, plans, assumptions and beliefs with respect to, among other things, Americas Silver’s financing efforts; production and cost performance at the Cosalá Operations and the Galena Complex; construction, production, development plans and performance expectations at the Relief Canyon Mine and the impact on Americas Silver’s financial performance; Often, but not always, forward-looking information can be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “goal”, “plan”, “intend”, “potential’, “estimate”, “may”, “assume” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of Americas Silver as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of Americas Silver to be materially different from those expressed or implied by such forward-looking information. With respect to the business of Americas Silver, these risks and uncertainties include interpretations or reinterpretations of geologic information; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms or at all; the ability to develop, complete construction and operate the Relief Canyon Mine; and risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), ground conditions and other factors limiting mine access, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities, labor relations, social and political developments and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Americas Silver’s filings with the Canadian Securities Administrators on SEDAR and with the SEC. Americas Silver does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law. Americas Silver does not give any assurance (1) that Americas Silver will achieve its expectations, or (2) concerning the result or timing thereof. All subsequent written and oral forward‐looking information concerning Americas Silver are expressly qualified in their entirety by the cautionary statements above.

For more information:

Darren Blasutti

President and CEO

Americas Silver Corporation

416‐848‐9503

[1] Silver equivalent production throughout this press release was calculated based on silver, zinc, and lead realized prices during each respective period.

[2] Cash cost per ounce and all-in sustaining cost per ounce are non-IFRS performance measures with no standardized definition. For further information and detailed reconciliations, please refer to the Company’s 2018 year-end and quarterly MD&A.