News

2019

TORONTO, ONTARIO—April 3, 2019—Americas Silver Corporation (TSX: USA) (NYSE American: USAS) (“Americas Silver” or the “Company”) is pleased to announce the results of a Preliminary Feasibility Study (“PFS”, “Study”) and initial mineral reserve estimate prepared internally by Company personnel for a combined operation at its 100% owned El Cajón and Zone 120 silver-copper deposits (“EC120”, “Project”) located near Cosalá, Sinaloa, Mexico. The base case economics for the EC120 Project are presented at long term consensus prices of $17.50 per ounce silver and $3.00 per pound copper, with all amounts expressed in US dollars.

EC120 Project PFS Highlights (all values in USD unless otherwise noted):

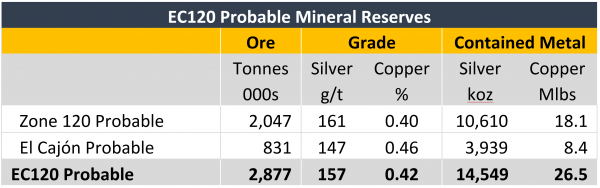

- Estimated probable mineral reserve of 2.9 million tonnes with a grade of 157g/t silver and 0.42% copper containing 14.5 million ounces of silver and 26.5 million pounds of copper

- 5-year mine life with average annual metal production of 2.5 million ounces of silver and 4.6 million pounds of copper (3.3 million silver equivalent ounces[1])

- The Project has a pre-tax net present value with a 5% discount rate (“NPV5%”) of approximately $43 million and internal rate of return (“IRR”) of 61% or after-tax NPV5% of $33 million and IRR of 47%

- Initial capital expenditure of approximately $17 million with life of mine sustaining capital of approximately $15 million[2]

- Life of mine cash cost[3]of approximately $9.60 per silver ounce and average all-in sustaining cost2 (“AISC”) of approximately $10.80 per silver ounce

“The EC120 Project is a significant addition to our precious metals growth pipeline,” said Darren Blasutti, President & CEO of Americas Silver. “Having a 2.5 million ounce per year silver project ready for immediate development fits into our strategy of preparing for the inevitable positive correction in the silver price. It provides a solid five-year production base as we continue to further explore the El Cajón and Zone 120 deposits and our other silver-rich exploration target areas in Cosalá later in 2019.”

The Study considers two underground operations with concurrent production from the adjacent El Cajón and Zone 120 deposits. Following an 18-month pre-production period, the combined operation will target a production rate of 1,800 tonnes per day. Overhand mechanized cut-and-fill will be the mining method utilized at both mines. The Project will take advantage of existing infrastructure and equipment currently in use at the producing San Rafael mine and existing development at the El Cajón deposit.

The Study assumes that processing will take place at the existing Los Braceros facility to produce a silver-bearing copper concentrate. The Los Braceros facility currently processes San Rafael ore to produce silver-bearing zinc and lead concentrates. Only minor modifications to the plant would be required to process ore from EC120. The existing tailings storage facility has capacity to store all planned production with scheduled dam lifts.

Based on the Study, the Project is expected to produce over 12 million ounces of silver and 23.0 million pounds of copper over a mine life of approximately 5 years. The life of mine all-in sustaining costs of the Project are expected to be below $11.00 per ounce of silver produced. The Company has not yet made a production decision with respect to the Project, however permits are in place to allow development to begin at any time.

The Probable Mineral Reserve estimate for EC120 as at April 3, 2019 is presented below.

Mineral Reserve Notes:

1. CIM (2014) Definition Standards were followed for Mineral Reserves.

2. Mineral Reserves are estimated at a net smelter return cut-off value of US$40/tonne at El Cajon and Zone 120.

3. Mineral Reserves are estimated using metal prices of US$16.00/oz Ag and $2.50/lb Cu.

4. A minimum mining width of 4 meters and a 15% dilution factor, at zero grade, was used for estimating Reserves at El Cajon and Zone 120. Mining recoveries vary between 80% to 95% depending on the width of the ore zone to reflect the proposed overhand cut and fill mining method.

5. The EC120 Mineral Reserve estimate was prepared internally by Shawn Wilson, P.Eng., who is a Qualified Person for the purpose of National Instrument 43-101 (“NI 43-101”).

6. Numbers may not add or multiply accurately due to rounding.

7. Americas Silver is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant issues that would materially affect this mineral reserve estimate.

Readers are encouraged to read the related technical report in its entirety once filed on the Company’s SEDAR profile at www.sedar.com and on the Company’s website at www.americassilvercorp.com to fully understand the information in this news release.

The technical information in this news release has been prepared and approved by Shawn Wilson, P.Eng., Vice President Technical Services for Americas Silver and a Qualified Person for the purpose of NI 43-101.

About Americas Silver Corporation

Americas Silver is a precious metal mining company focused on growth from its existing asset base and execution of targeted accretive acquisitions. It owns and operates the Cosalá Operations in Sinaloa, Mexico and the Galena Complex in Idaho, USA. The Company holds an option on the San Felipe development project in Sonora, Mexico. For further information please see SEDAR or americassilvercorp.com.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information includes, but is not limited to, Americas Silver’s and Pershing Gold’s expectations, intentions, plans, assumptions and beliefs with respect to, among other things, Americas Silver’s potential advancement of the EC120 Project. Often, but not always, forward-looking information can be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “goal”, “plan”, “intend”, “estimate”, “may”, “assume” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of Americas Silver as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of Americas Silver to be materially different from those expressed or implied by such forward-looking information. With respect to the business of Americas Silver, these risks and uncertainties include interpretations or reinterpretations of geologic information; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms or at all; and risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), ground conditions and other factors limiting mine access, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital expenditures, reclamation activities, labor relations, social and political developments and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Americas Silver’s filings with the Canadian Securities Administrators on SEDAR and with the SEC. Americas Silver does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law. Americas Silver does not give any assurance (1) that Americas Silver will achieve its expectations, or (2) concerning the result or timing thereof. All subsequent written and oral forward‐looking information concerning Americas Silver, the EC120 Project, or any person acting on the behalf of Americas Silver are expressly qualified in their entirety by the cautionary statements above.

No Offer or Solicitation

This press release is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer or sale of securities shall be made except pursuant to registration under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), and any applicable state securities laws or in compliance with an exemption therefrom.

Cautionary Note to U.S. Investors:

The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource”, “inferred mineral resource” used in the press release are Canadian mining terms used in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum Standards. Mineral resources which are not mineral reserves do not have demonstrated economic viability.

While the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource”, and “inferred mineral resource” are recognized and required by Canadian regulations, they are not defined terms under standards in the United States and normally are not permitted to be used in reports and registration statements filed with the Securities & Exchange Commission (“SEC”). As such, information contained in the Company's disclosure concerning descriptions of mineralization and resources under Canadian standards may not be comparable to similar information made public by U.S companies in SEC filings. With respect to “inferred mineral resource” there is a great amount of uncertainty as to their existence and a great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves.

For more information:

Darren Blasutti

President and CEO

416‐848‐9503

Andrea Totino

IR Manager

416-866-1866

[1] Silver equivalent ounces are calculated using metal prices of $17.50/oz silver and $3.00/lb copper

[2] Initial capex excludes working capital and pre-production operating costs net of revenue

[3] Cash cost per ounce and all-in sustaining cost per ounce are non-IFRS performance measures with no standardized definition. The Company reconciles such measures to IFRS measures as shown in the Company’s 2018 Management’s Discussion and Analysis under the heading “Non-IFRS measures: Cash Costs per Ounce and All-in Sustaining Cost per Ounce.” For further information on the PFS non-IFRS measures, please see the pre-feasibility study once it is filed on www.SEDAR.com.